Celebrities are everywhere: on TV, magazines, billboards and all across our social media feeds. So, in theory, recognizing them should be pretty easy, especially because some have a very distinctive appearance. We decided to put that to the test by seeing if you can guess the celebrity just by one facial feature. If you’re good at remembering faces, you might just nail this!

Don’t forget to click on each image to reveal the answers.

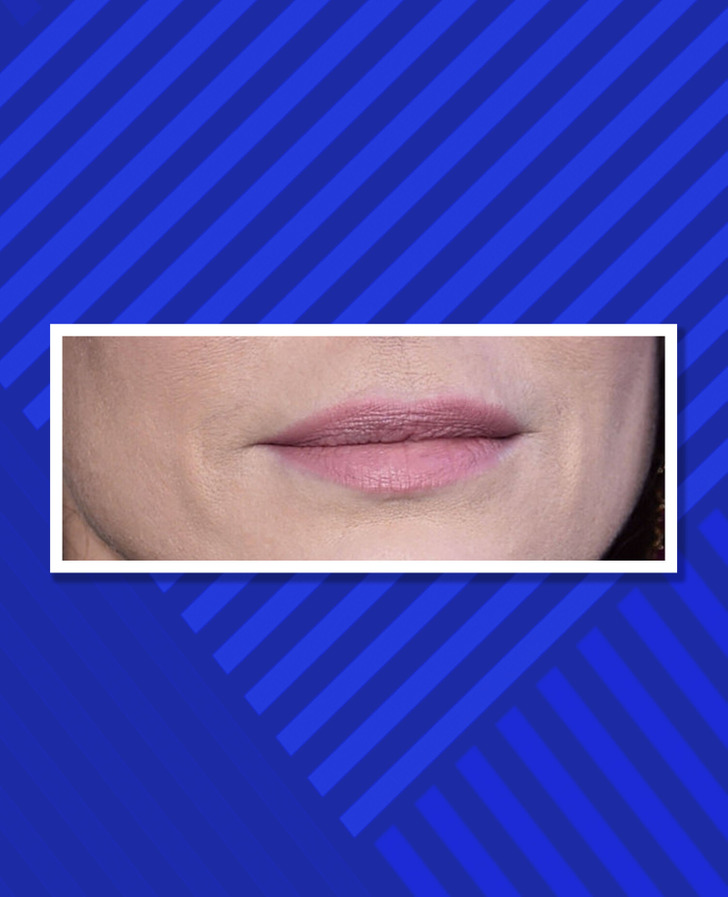

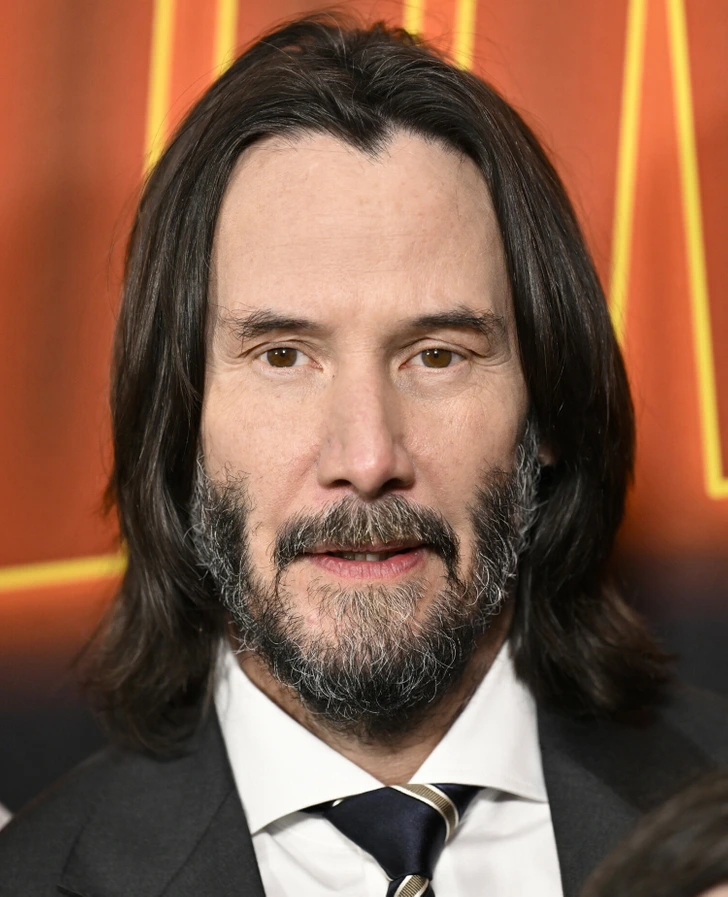

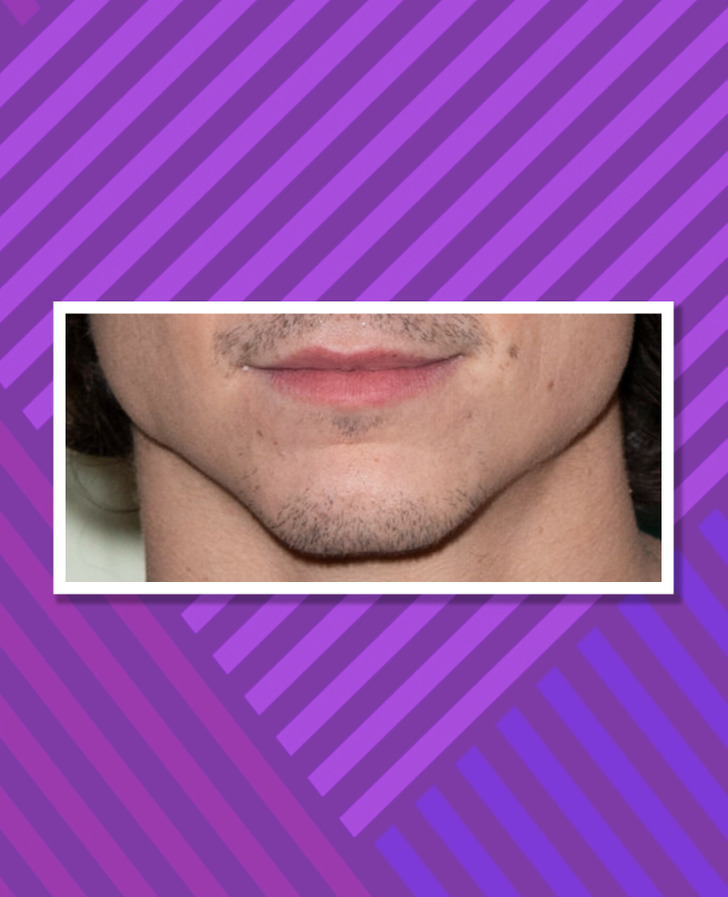

1. Whose lips are these?

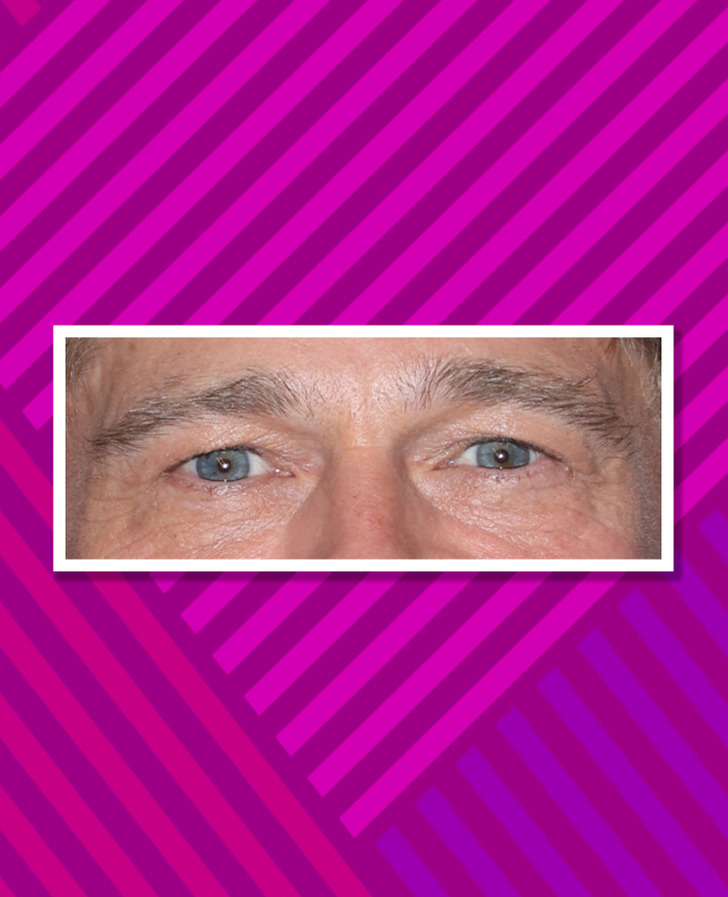

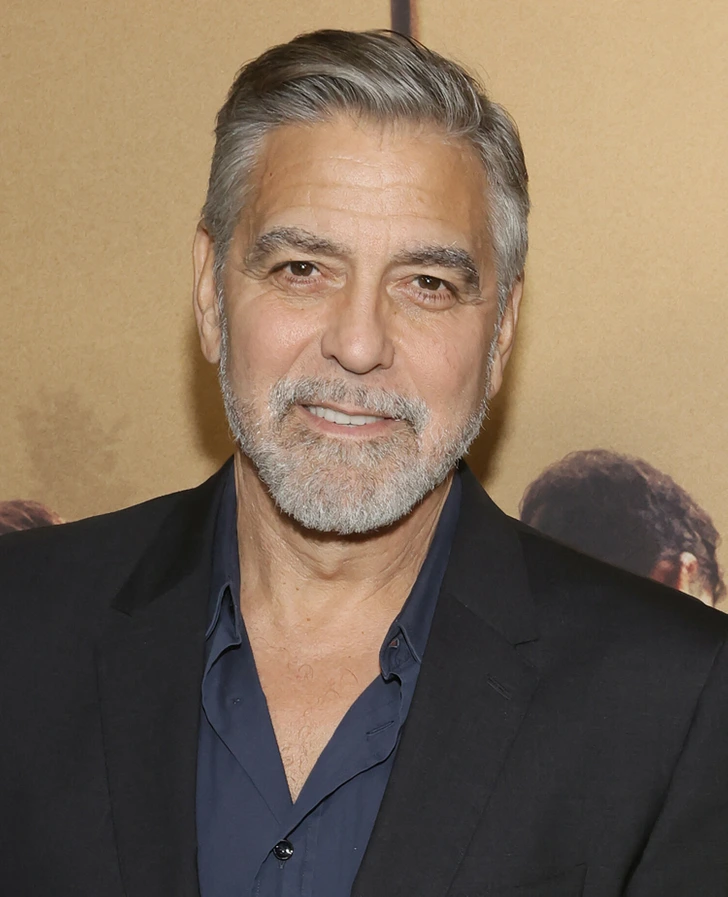

2. Whose eyes are these?

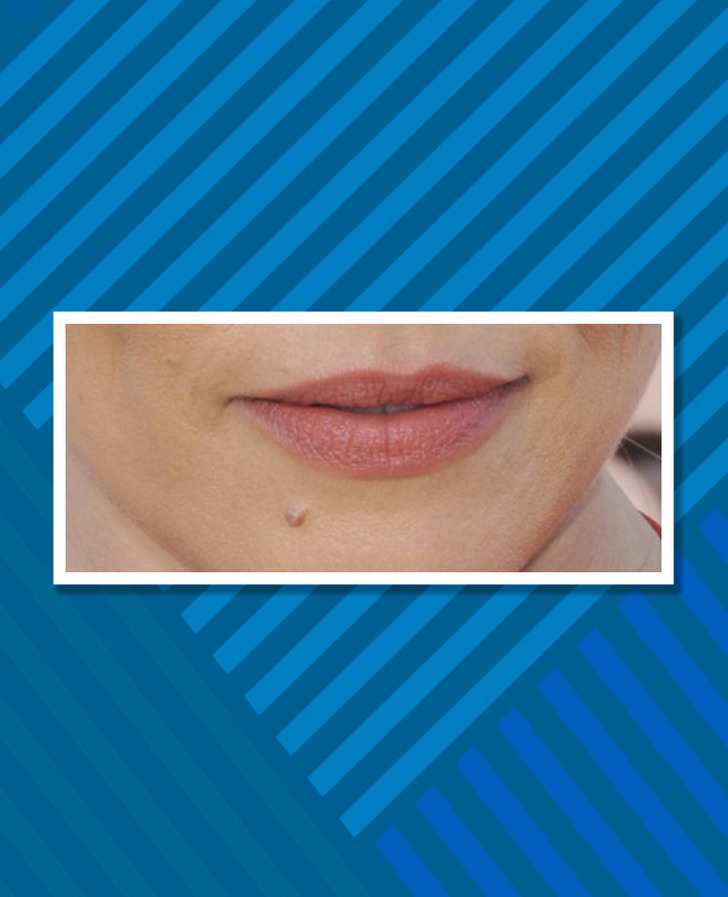

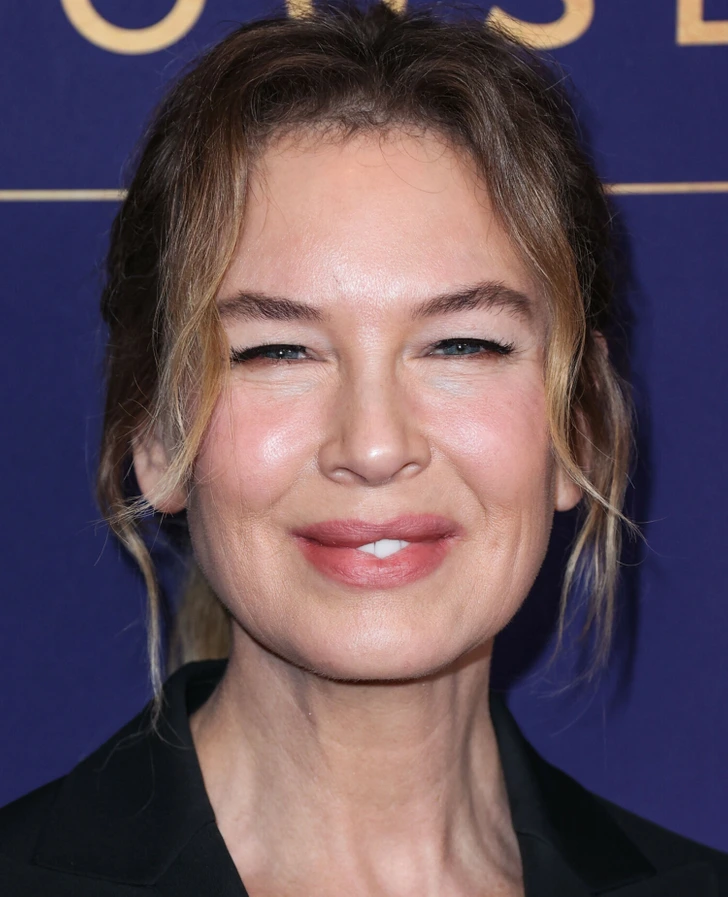

3. Whose beauty mark is this?

4. Whose nose is this?

5. Whose hairline is this?

6. Whose cheeks are these?

7. Whose jawline is this?

8. Whose eyes are these?

9. Whose ear is this?

10. Whose eyebrows are these?

It’s healthy to stimulate your mind with different exercises. With these two simple tests here, you’ll be able to see if your brain is doing well. Check them out!

My MIL Demanded to Sit Between Me and Her Son at Our Wedding – She Didn’t Expect Me to Agree So Easily

When Julia’s future mother-in-law, Patricia, demanded a seat between her and Ethan at their wedding, it seemed like another over-the-top move in a long list of controlling behaviors. But Julia’s response wasn’t what anyone expected.

When I agreed to Patricia’s absurd demand on my wedding day, I saw the look of triumph on her face. She thought she’d won, and that I’d back down like I always had before.

But this time was different. This time, I had a plan that would make her re-evaluate her actions.

A woman standing in her bedroom | Source: Midjourney

When I got engaged to Ethan, I knew I wasn’t just marrying him.

I was also marrying into his tight-knit, borderline suffocating relationship with his mother, Patricia. She loved Ethan fiercely, and while that’s usually a good thing, in this case, it felt like I was competing with her for his attention.

From the moment we announced our engagement, Patricia seemed to think it was her wedding, not mine.

A man holding a woman’s hand | Source: Pexels

“Oh, Julia, lilies are too plain for a wedding,” she’d said during our first meeting with the florist, wrinkling her nose. “Roses are more elegant. Ethan loves roses, don’t you, sweetheart?”

Ethan had nodded absentmindedly, scrolling on his phone.

I just smiled as I reminded myself to pick my battles. But it wasn’t just the flowers.

The thing is, she had opinions on everything. And guess what? She even had the audacity to tell me what to wear on my big day.

A mature woman looking straight ahead | Source: Midjourney

“Are you sure you want to wear something so… fitted?” she asked during a fitting. “It might be uncomfortable for the ceremony.”

I laughed it off, but deep down, I was fuming.

I let it slide because I knew arguing with Patricia meant trying to move a boulder uphill. Explaining anything to her wasn’t worth the effort because she had this ‘I-know-I-am-always-right’ kind of attitude.

A woman standing in a living room | Source: Midjourney

One evening, I invited her over for dinner, hoping to bridge the gap.

I spent hours cooking Ethan’s favorite lasagna from scratch, with garlic bread and a Caesar salad.

When she arrived, I greeted her warmly, trying to make her feel welcome.

When Ethan tasted the lasagna, he couldn’t help but praise my cooking skills.

“Wow, this is amazing, Jules!” he said. “I love it!”

But Patricia couldn’t watch her son speak in my favor.

“Well, of course, it’s good,” she said, her voice dripping with sarcasm. “Lasagna isn’t exactly rocket science, is it?”

A dish of lasagna | Source: Pexels

Ethan didn’t even notice what her mother said, while I could feel my cheeks burning.

“I’m glad you like it, Ethan,” I said softly, forcing myself to stay calm.

Later that evening, as I cleared the plates, she cornered me in the kitchen.

A woman standing in a house | Source: Midjourney

“Julia,” she began, “I know you mean well, but a man like Ethan needs more than just a pretty face and a passable lasagna. Marriage is a lot of work, dear.”

I wanted to snap back, to tell her to stop undermining me in my own home. But instead, I nodded and said, “Thank you for the advice, Patricia. I’ll keep that in mind.”

The incidents kept piling up.

A woman standing a window | Source: Pexels

Like the time she “accidentally” booked a weekend spa trip with Ethan the same weekend we had planned to visit a venue.

“Oh, I didn’t realize you’d made plans,” she said, feigning innocence. “Ethan, you’ll still come with me, won’t you?”

And, of course, he did.

But even with all of that, I never expected Patricia to pull a stunt at the wedding itself.

That was the moment I realized I couldn’t stay silent anymore.

A bride standing at her wedding | Source: Pexels

The day of the wedding was beautiful.

Bright skies, a gentle breeze, and the kind of warmth that made everything feel just right.

I should’ve been focused on the joy of marrying Ethan, but the moment Patricia arrived, it was clear the spotlight wasn’t mine to keep.

She stepped out of her car in a white, floor-length lace dress with glittering rhinestones, a small train trailing behind her.

A woman in a white gown | Source: Midjourney

For a second, I thought she’d accidentally swapped dresses with me. Then I realized it wasn’t an accident.

“Ethan, darling! Look at you!” Patricia beamed, rushing over to him as I stood just a few feet away. “Doesn’t he look like the most handsome man in the world, Julia?” she asked, not waiting for an answer as she smoothed his tie and kissed his cheek.

I smiled tightly. “He does, Patricia. You must be so proud.”

“Oh, I am,” she gushed. “He’s always been my rock, my number one.”

A woman at her son’s wedding | Source: Midjourney

That was Patricia’s signature move. To make sure everyone knew exactly where she stood in Ethan’s life.

At that point, I reminded myself to breathe. This was my day, not hers. Or at least, it was supposed to be.

When it was time for the reception, I was ready to let go of the small jabs and focus on enjoying the evening.

A woman in her wedding gown | Source: Midjourney

Ethan and I walked to the head table, hand in hand, smiling at our guests. But just as we reached our seats, I noticed Patricia hovering nearby.

Before I could process what was happening, she grabbed a chair from a nearby table, dragged it loudly across the floor, and wedged it right between Ethan and me.

“There!” she announced, plopping down with a smug smile. “Now I can sit next to my son. I wouldn’t want to miss a moment with him on such a special day.”

A mature woman at her son’s wedding reception | Source: Midjourney

A ripple of gasps spread through the room.

I glanced at Ethan, waiting for him to say something, anything, to put this situation right.

Instead, he just shrugged.

“Patricia, this is the bride and groom’s table,” I said. “We’re supposed to sit together.”

But Patricia wasn’t one of those people who’d understand so easily.

“Oh, Julia,” she sighed. “Don’t be so sensitive. I am the most important woman in his life, and I always will be. You should respect that.”

A man at his wedding | Source: Midjourney

That’s when Ethan finally spoke up. But he didn’t say what I wanted him to.

“It’s fine, babe,” he said, as if this were no big deal. “It’s just a chair.”

Just a chair, I thought. Just a chair? Alright.

“You know what, Patricia?” I said with a sweet smile. “You’re absolutely right. Let’s do it your way.”

Her face lit up with surprise, and she grinned as though she’d won.

Little did she know, I had a plan in my mind that would make her face flush with embarrassment.

A young woman thinking about her plan | Source: Midjourney

Patricia leaned back in her chair, basking in what she clearly thought was her victory.

Meanwhile, Ethan busied himself greeting guests as though nothing unusual had happened.

I stayed seated for a few minutes as I forced a smile and pretended to go along with the charade. But inside, I was seething.

“Excuse me for a moment,” I said, standing up and smoothing my dress. “I need to step away for a bit.”

Neither Patricia nor Ethan paid much attention as I walked toward the hallway.

A bride walking away | Source: Midjourney

Once I was out of sight, I pulled out my phone to make an important call.

“Hi, this is Julia,” I said, my voice calm and composed despite the fire burning inside me. “I need to make a last-minute adjustment to the cake. Yes, I know it’s short notice, but it’s really important.”

The person on the other end hesitated for a moment before asking for details. I smiled to myself, knowing this would be worth every extra penny.

A woman standing in a hallway | Source: Midjourney

“I’ll send you a photo right now,” I continued. “Just follow the instructions, and make sure it’s delivered before the cake cutting. Can you make it happen?”

The answer was a tentative yes, and I quickly sent over the picture and specifics.

“Perfect,” I said. “Thank you so much.”

After hanging up, I took a moment to collect myself, adjusting my veil and letting the grin tugging at the corners of my lips fade into a neutral expression.

A close-up shot of a woman’s lips | Source: Pexels

By the time I returned to the head table, Patricia was still holding court, reliving one of Ethan’s childhood stories for the hundredth time.

I sat down quietly, keeping my eyes on her and mentally counting down the moments until my plan unfolded.

Then came the time for the first dance, and I was ready for Patricia’s next move.

Sure enough, as the music started and Ethan extended a hand toward me, Patricia swooped in like a hawk.

A woman ready for the dance | Source: Midjourney

“Oh, Ethan, let’s show them how it’s done!” she said, grabbing his hand and practically dragging him to the dance floor before I could respond.

I stood there and watched as they swayed to the music.

Patricia beamed as she danced with her son, while the guests exchanged uneasy glances.

“That’s… unusual,” I heard one guest murmur.

“Isn’t the first dance supposed to be with the bride?” another whispered.

But I just smiled, keeping my expression serene. If anyone thought I was upset, they were wrong.

This was all going exactly how I wanted it to.

A woman smiling at the camera | Source: Midjourney

After what felt like an eternity, Ethan finally returned to the table.

“Sorry about that,” he mumbled as he sat down.

“It’s fine,” I lied.

I glanced at Patricia, who was enjoying the attention she thought she’d stolen.

And then came the moment I’d been waiting for. The cake cutting.

The lights dimmed, and my bridesmaids carried in the three-tiered masterpiece, sparklers flickering as the crowd clapped and cheered.

Patricia’s smile widened as the cake approached, but when it came fully into view, she looked at it with wide eyes.

A close-up shot of a woman’s face | Source: Midjourney

Perched on top of the cake were two figurines, and they were not of a bride and groom.

Instead, they showed a groom and his mother, posed arm-in-arm. The resemblance was uncanny. Ethan’s tie and Patricia’s pearl necklace were all there.

“Surprise!” I cheered. “How’s the cake, Patricia?”

“Julia…” she stammered, her voice trembling. “W-What is this supposed to mean?”

A woman standing outdoors | Source: Midjourney

I stood up slowly with the microphone in my hand.

“Patricia, Ethan,” I smiled as I looked at them. “I wanted to honor the bond you two share. It’s clear to everyone here that you’re the real pair of the evening. So, please cut this beautiful symbol of your relationship together. You deserve it.”

The room erupted into murmurs, a few stifled giggles escaping here and there. Patricia’s hands shook as I placed the knife in her grasp.

“Go on,” I said sweetly. “Everyone’s watching.”

A woman at her wedding reception | Source: Midjourney

Patricia looked to Ethan, her eyes pleading, but he was too stunned to speak.

“Julia,” she hissed through gritted teeth. “This is inappropriate.”

“Inappropriate?” I echoed with mock surprise. “Oh, Patricia, don’t be so sensitive. After all, you’re the most important woman in his life. Isn’t that what you’ve been telling me?”

A ripple of laughter spread through the guests, and I knew I had them on my side. Meanwhile, Patricia’s friends exchanged awkward glances. They felt clearly uncomfortable with the spectacle.

Two women attending the wedding reception of their friend’s son | Source: Midjourney

I leaned into the microphone one last time. “Now, if you’ll excuse me, I have better things to do than fight for scraps of attention on my own wedding day.”

I turned on my heel, signaled to my bridesmaids, and walked out of the reception.

Behind me, I heard chairs shuffle, whispers grow louder, and the faint clinking of glasses. The crowd was beginning to disperse, leaving Patricia and Ethan in the awkward spotlight.

A close-up shot of a woman with a serious look | Source: Midjourney

By the time we reached the limo, my bridesmaids and I were laughing so hard, we could barely breathe.

We popped champagne and toasted to freedom. They understood why I’d decided not to marry Ethan.

Later, I heard Patricia tried to save face, but even her closest friends had their limits.

“You brought this on yourself,” one reportedly told her.

And Ethan? Well, he did come begging for another chance, but I was done. I canceled the marriage license the next morning and officially closed that chapter of my life.

A woman standing in a hallway | Source: Midjourney

No regrets, and no second thoughts. Just a massive amount of relief and the knowledge that Patricia finally got the attention she always craved.

What would you have done if you were in my shoes?

If you enjoyed reading this story, here’s another one you might like: Caught in the whirlwind of wedding bliss and familial conflict, Candice’s story unravels at the seams when her mother-in-law’s antics push her to a breaking point.

This work is inspired by real events and people, but it has been fictionalized for creative purposes. Names, characters, and details have been changed to protect privacy and enhance the narrative. Any resemblance to actual persons, living or dead, or actual events is purely coincidental and not intended by the author.

The author and publisher make no claims to the accuracy of events or the portrayal of characters and are not liable for any misinterpretation. This story is provided “as is,” and any opinions expressed are those of the characters and do not reflect the views of the author or publisher.

Leave a Reply