A young girl faced a difficult childhood marked by her mother’s struggles with alcohol and her famous father dying in a devastating car crash when she was just a teenager. However, she found a way forward, honoring her father’s legacy while creating her own. Here’s her inspiring journey.

Onscreen, he was known as a fearless driver and an icon of the “Fast & Furious franchise. Behind the scenes, however, this Hollywood star took on an even more cherished role: a devoted father to his only daughter.

But tragedy struck when he passed away, leaving her to face life without his steady presence. Since then, she’s navigated a path marked by both the heartbreak of his absence and her mother’s long battle with addiction. Take a look at what happened to the little girl he left behind and where she is today.

A Father’s Heartfelt Bond with His Only Daughter

This actor, renowned for his role as Brian O’Conner in the blockbuster “Fast & Furious” franchise, captivated audiences with his charisma, baby blues, and passion for high-octane action. With a career that spanned over a decade, he became one of Hollywood’s most beloved stars.

However, he found his most cherished role off-screen: being a father. On November 4, 1998, he welcomed a daughter, his only child, with his then-girlfriend, Rebecca Soteros, whom he met in California in early 1998.

Rebecca McBrain worked as a primary school teacher and led a private life with her daughter in Hawaii. However, the actor, who had shared custody, remained closely involved in his little girl’s life, visiting regularly and even teaching her to surf at just seven.

“She really loves it,” the Hollywood star shared. By the time she was 14, Meadow lived with her dad full-time.

The “Fast and Furious” star spoke openly about the impact of this change, revealing, “My heart was desperate for so many years with the situation with my daughter […] She’s the best partner I’ve ever had. It’s so nuts. I’ve never had anything like this in my life.”

His mother had told him that little girls had a way of softening their father’s hearts, and his daughter proved it true. “She’s a bit more like her mother, but she’s also how I am innately,” the proud father beamed.

A Devastating Loss

Tragedy struck in November 2013 when this beloved actor lost his life in a devastating car accident in Southern California. He was riding as a passenger in a Porsche Carrera GT when the driver lost control, crashing into what was believed to be a post or tree trunk and igniting a deadly fire.

The news shocked fans and loved ones alike, and at just 15 years old, his daughter faced the unimaginable loss of her father. According to reports, just hours before the crash, the actor had reached out to his mother, sharing his worries about not being able to properly care for his daughter amid his busy work schedule.

He expressed the need for his mom to become a full-time guardian, saying he was overwhelmed and could no longer manage the demands of parenting alongside his career.

Sources close to the “Fast and Furious” star’s family revealed that he approached his mother, Cheryl, on the day of his passing and asked her to retire from her nursing job to take care of his daughter full-time.

Allegedly, the young girl moved in with her grandmother only three months before her father died when Cherly was still working as a nurse. However, after an unsuccessful search for nannies and child care, he turned to his mother to be her granddaughter’s full-time guardian.

On the morning of his death, after his mother agreed to look after her granddaughter, the actor called his loved one to let them know.

The young girl’s biological mother had long struggled with alcohol issues, which made her father hesitant to consider her as a primary caregiver. Following the actor’s passing, her grandmother filed to become his daughter’s legal guardian.

Her mother, who was arrested for a DUI in 2014, had previous run-ins with the law due to drinking-related offenses. Her first arrest, dating back to 2003 in Orange County, led to a guilty plea and three years’ probation.

Unfortunately, the issue resurfaced when she faced another DUI charge in Hawaii the previous year, a case that remained unresolved. Family sources indicated that Rebecca’s alcohol problems had been ongoing, leading to numerous conflicts between both parents.

In addition to her grandmother, the young girl’s bond with her Godfather, actor and “Fast and Furious” co-star Vin Diesel, became a crucial source of support during this difficult time. “She counts Vin and his kids as family and will talk to them on days she’s struggling, and she has their backs too,” an insider revealed.

Keeping His Legacy Alive

This famous actor is none other than Paul Walker, and following his death, his daughter, Meadow Rain Walker, has embraced her father’s legacy while forging her own path.

She founded the Paul Walker Foundation, dedicated to ocean conservation and humanitarian aid — causes her father passionately supported during his life.

After Haiti’s catastrophic 2010 earthquake, Paul founded Reach Out World Wide (ROWW), a non-profit focused on transporting first responders to disaster-stricken regions to strengthen local relief efforts.

Rather than simply donating money, he was passionate about working directly in the field. Cody recalled his brother’s words, “No, I want to get in there and I want to help. I don’t want to be part of some big old PR campaign or anything like that. I want to go to Haiti.”

Cody further shared how proud his brother would be of his Meadow, who now heads the Paul Walker Foundation, a charitable organization that supports ocean conservation efforts. He remarked, “I would tell him that his daughter has done a wonderful job creating her foundation in honor of him in preserving our oceans.”

Vin Diesel also opened up about keeping Paul’s memory alive, revealing during an interview that it was “very important” to him to do so. He also shed light on his relationship with Meadow, revealing that in addition to taking care of her, she also takes care of him.

In October 2021, when Meadow married her partner, Louis Thornton-Allan, her Godfather lovingly stepped in to walk her down the aisle in her father’s place. This moment exemplified the close relationship they shared, especially after her father’s passing.

Meadow and her husband eventually separated two years later, parting on amicable terms. “After three wonderful years of marriage, we have come to the agreement to amicably separate. This is truly a united decision and we sincerely hope that everyone can respect our wishes for privacy,” they shared in part on Instagram.

As for her professional life, Meadow has made significant strides in modeling. In 2023, she became the face of Givenchy Beauty, exclaiming on Instagram, “WOW! Another dream come true!!”

Reflecting on her journey, she humorously recalled her tomboy upbringing with her dad, “We would do boys’ activities, roll around in the mud, play soccer, and just be crazy. So, it wasn’t until I was a bit older that I discovered magazines, fashion, and seeing models such as Kate Moss, and being like, She’s really beautiful.'”

Following her transformation into a fashion icon, Meadow was 22 when she opened the Fall 2021 Givenchy show. She had amassed four million followers on Instagram at the time of writing and continued to make waves in her industry.

Meadow Rain Walker has continued her father’s legacy, honoring his passion for helping others and his love for the ocean. As she builds a life in his memory, she embodies the spirit of the man who cherished being her father.

You Won’t Believe How Much John Travolta’s Daughter Looks Like Him at the 2024 Academy Museum Gala

John Travolta recently showed up at a big event in California with his oldest child. Like before, people were talking about which parent she looks like more.

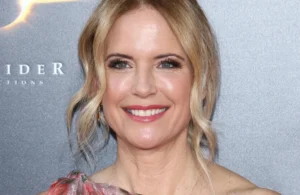

On October 19, 2024, John Travolta caught the attention of many when he attended The Fourth Annual Academy Museum Gala with his daughter, Ella Bleu Travolta. Photos of the pair had people debating whether Ella looks more like her late mother, Kelly Preston, or her father.

John Travolta recently attended a big event in Los Angeles with his oldest child. The two posed together for red carpet photos, with Ella linking her arm through her father’s as they smiled for the cameras.

After their photos were shared on social media, many people commented on how much Ella looked like her father. One person wrote, “She is his twin! His beautiful daughter .” Another commenter noted, “All I see is her dad, lol. Like his mini-me.”

Some agreed with the comparisons, saying, “She’s beautiful! She has her dad’s eyes!” Others thought Ella resembled her late mother, Kelly Preston. One comment said, “I see her mom in her. Blessings to them. He seems to be a great father.”

Another user added, “The older she gets, the more she looks like Kelly Preston. What a beautiful young woman. You’ve done well, John. You must be so proud of her.” Someone else observed, “Ella’s resemblance to her mom Kelly is striking; she’s gorgeous!”

For those who had a different opinion, one person remarked, “She is the spitting image of her mom!” Another noted, “I think she is a perfect mix of them both. She is stunning.”

One netizen shifted the focus back to John, saying, “He is such a good man and a good father

When John and Ella appeared at the 2024 Paris Olympics on August 3, fans again noticed their resemblance. They attended to support the USA’s gymnasts, and many commented on how alike they looked.

One observer said, “She looks just like him,” while another remarked, “Look at his beautiful daughter, who is his doppelganger.” A third fan added, “She took his whole face!”

Others praised Ella, with one fan saying, “Wow she is beautiful .” Longtime fans of John, who remembered his role in the 1978 classic “Grease,” noted similarities between him and Ella. One fan said, “She’s John in Grease ,” and another added, “She is his twin from his younger days. Just watched Grease; never realized how handsome he was.”

Some fans also saw a resemblance to Uma Thurman’s character from “Pulp Fiction,” where John co-starred. One observer suggested, “She looks like she can star in Pulp Fiction.”

At the Academy Museum Gala, both wore matching black outfits. John wore a dark blazer, a matching T-shirt, blue jeans, sunglasses, and black shoes. Ella’s outfit featured a sleeveless black cropped top and high-waisted pants, which she paired with a black beret and strappy heels.

The pair sat in the VIP section with other celebrities, cheering for US gymnast Simone Biles during the finals.

In April 2024, Ella debuted her new bob haircut on Instagram, showing off her dark brown locks styled to frame her face. She playfully captioned the photo, “Fresh cut grass.”

Leave a Reply